In this Article

Filing your Form 1040 tax return can be stressful, especially when you consider that even small errors can lead to processing delays, reduced refunds, or unwanted IRS notices. Each year, millions of taxpayers make preventable mistakes that cost them time and money. Understanding these common pitfalls is your first step toward a smooth, error-free tax filing experience that maximizes your potential refund while minimizing stress.

Whether you’re filing your taxes yourself or working with a professional, being aware of these common Form 1040 filing mistakes can help ensure your return is accurate and processed without delay. Let’s explore the most frequent errors taxpayers make and how you can avoid them.

Key Takeaway: The IRS estimates it takes the average taxpayer 13 hours to prepare their annual return, yet many still make errors that can lead to penalties, delayed refunds, or missed tax savings opportunities.

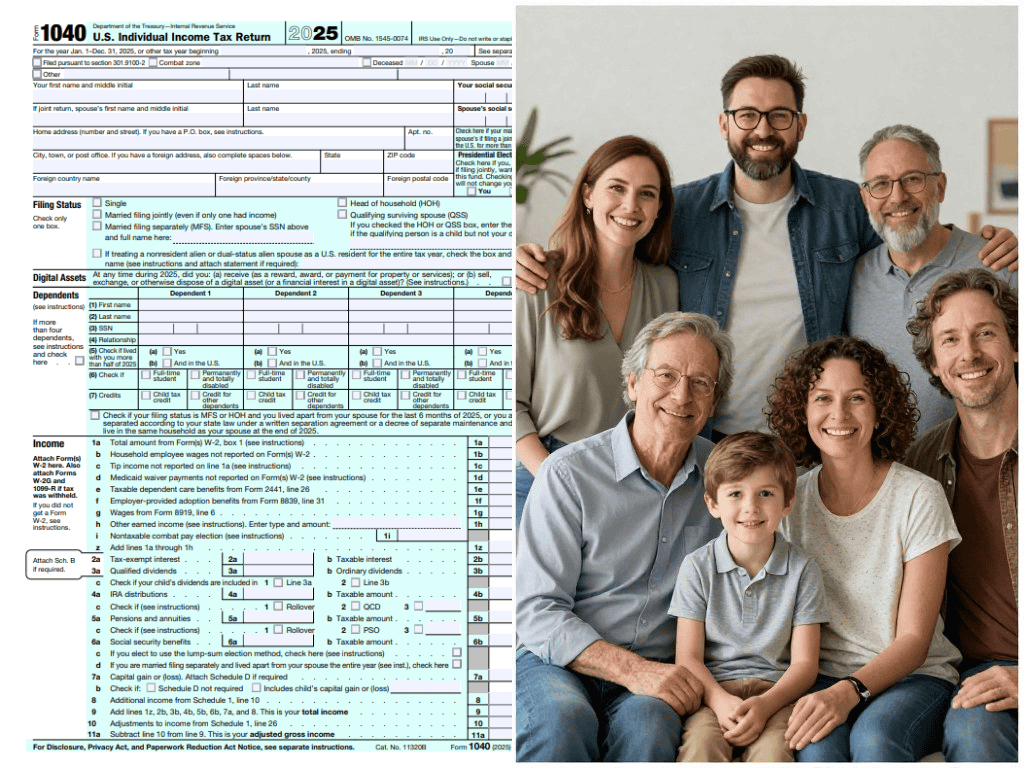

1. Entering Incorrect Personal Information

One of the most common Form 1040 filing mistakes involves incorrect personal information. The IRS automatically matches the information on your return with its records, and discrepancies can trigger processing delays or even rejection of your return.

What to Double-Check:

- Social Security Numbers for yourself, spouse, and dependents

- Name spelling (exactly as it appears on your Social Security card)

- Current mailing address

- Date of birth information

If you’ve recently changed your name due to marriage or divorce, make sure you’ve notified the Social Security Administration before filing your taxes to avoid mismatches.

2. Selecting the Wrong Filing Status

Your filing status determines your standard deduction, tax brackets, and eligibility for certain credits. Choosing incorrectly can significantly impact your tax liability.

| Filing Status | Who Qualifies | Standard Deduction (2025) |

| Single | Unmarried or legally separated individuals | $15,750 |

| Married Filing Jointly | Married couples who combine income and deductions | $31,500 |

| Married Filing Separately | Married individuals who file separate returns | $15,750 |

| Head of Household | Unmarried individuals who pay more than half the cost of keeping a home for a qualifying person | $23,625 |

| Qualifying Widow(er) | Surviving spouse with dependent child (within 2 years of spouse’s death) | $31,500 |

Many taxpayers incorrectly claim Head of Household status without meeting all requirements, which can trigger an IRS review. If you’re unsure which status applies to your situation, the IRS provides an interactive tool to help determine the correct filing status.

3. Making Math and Calculation Errors

Even simple arithmetic errors can cause significant problems with your tax return. While tax software has reduced the frequency of calculation mistakes, they still occur, especially when:

- Adding income from multiple sources

- Calculating taxable Social Security benefits

- Determining deduction amounts

- Computing tax credits

The IRS will correct mathematical errors, but these corrections can change your refund amount or create a balance due that you weren’t expecting.

To avoid calculation errors if you are not working with an accountant, consider using tax preparation software or e-filing services that automatically perform calculations. If you’re filing a paper return, double-check all your math before submitting.

4. Forgetting to Report All Income

The IRS receives copies of all your income documents (W-2s, 1099s, etc.), and their systems automatically match these against what you report. Failing to include all sources of income is one of the most common Form 1040 filing mistakes that can trigger an audit.

Income Sources Often Overlooked:

- Interest income (1099-INT)

- Dividend payments (1099-DIV)

- Freelance or gig work (1099-NEC/1099-MISC)

- Unemployment compensation

- Retirement distributions

- Social Security benefits

- Gambling winnings

- Income from rental properties

Even if you don’t receive a form for income earned (like cash payments for small jobs), you’re still legally required to report it on your tax return.

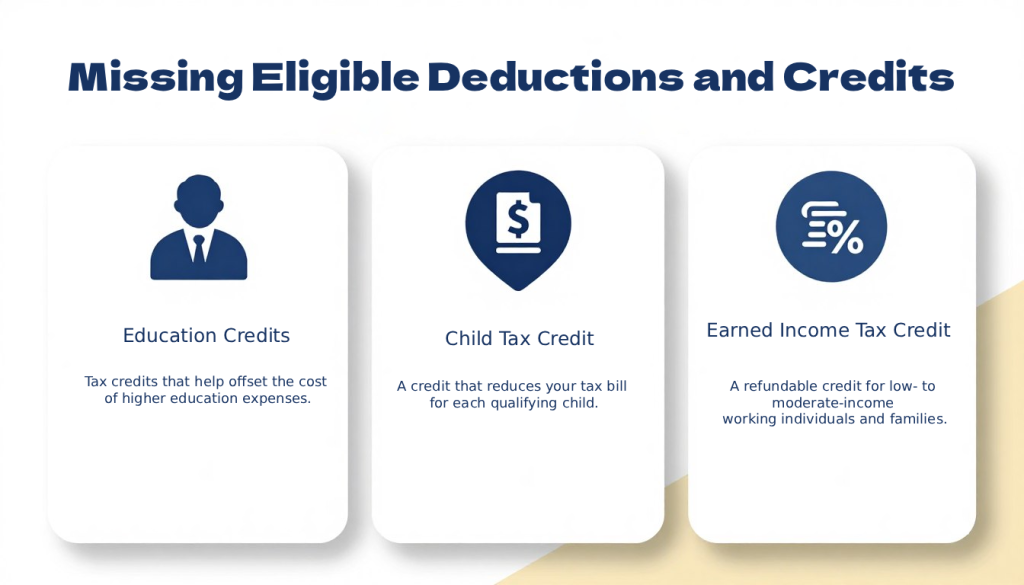

5. Missing Eligible Deductions and Credits

Overlooking legitimate tax deductions and credits is essentially leaving money on the table. These tax benefits can significantly reduce your tax liability or increase your refund.

Commonly Missed Deductions

- Student loan interest (up to $2,500)

- State and local tax payments

- Charitable contributions

- Medical expenses exceeding 7.5% of AGI

- Home office expenses (if self-employed)

Frequently Overlooked Credits

- Earned Income Tax Credit

- Child and Dependent Care Credit

- American Opportunity Credit (education)

- Lifetime Learning Credit

- Retirement Savings Contributions Credit

6. Providing Incorrect Bank Account Information

If you’re expecting a refund via direct deposit, incorrect bank information can significantly delay your money. Each year, thousands of refunds are misdirected due to transposed digits or outdated account information.

Tips to Avoid Banking Errors:

- Verify both your routing number (9 digits) and account number before submitting

- Double-check that your account is still active

- Confirm whether you’re entering a checking or savings account

- Consider using a voided check to verify the numbers

If you provide incorrect bank information, your direct deposit will be rejected, and the IRS will mail a paper check instead, adding weeks to your refund timeline.

7. Forgetting to Sign Your Tax Return

It may seem obvious, but an unsigned tax return is considered invalid by the IRS. This simple oversight is one of the most common Form 1040 filing mistakes that can delay processing by weeks.

For joint returns, both spouses must sign even if only one had income. E-filed returns require electronic signatures (usually a PIN) from both spouses.

If you’re filing by mail, make signing your return the final step in your tax preparation process. For e-filed returns, follow the software prompts to properly sign electronically.

8. Missing Filing Deadlines or Estimated Payments

Filing late without an extension or missing estimated tax payment deadlines can result in significant penalties and interest charges.

| Tax Deadline | What’s Due | Penalty for Missing |

| April 15 | Annual tax return or extension request + payment of taxes owed | 5% of unpaid taxes per month (up to 25%) |

| April 15, June 15, Sept 15, Jan 15 | Quarterly estimated tax payments | Penalty based on the federal short-term rate plus 3% |

| October 15 | Extended tax return deadline | 5% of unpaid taxes per month (up to 25%) |

Remember: An extension to file is NOT an extension to pay. You must still pay any estimated taxes owed by the original deadline to avoid penalties.

9. Incorrectly Reporting Dependents

Errors in claiming dependents can trigger IRS notices or audits. To properly claim someone as a dependent, they must meet specific relationship, residency, and support tests.

Common Dependent Reporting Mistakes:

- Claiming a dependent who is also claiming themselves

- Multiple taxpayers claiming the same dependent

- Missing or incorrect Social Security Numbers

- Claiming dependents who don’t meet the qualifying criteria

For divorced or separated parents, only one parent can claim a child as a dependent. Usually, this is the custodial parent, but exceptions exist with proper documentation.

10. Not Keeping Proper Documentation

While this mistake doesn’t directly affect your filing, failing to keep adequate supporting documentation can cause serious problems if you’re audited.

Records to Keep for at Least 3 Years:

- W-2s and 1099 forms

- Receipts for deductible expenses

- Charitable donation records

- Medical expense documentation

- Property tax statements

- Mortgage interest statements

- Previous years’ tax returns

- Investment purchase/sale records

11. Overlooking State Tax Requirements

Federal Form 1040 errors often carry over to state returns, and each state has its own filing requirements and deadlines. Don’t forget to:

- Check if you need to file in multiple states (if you moved or worked across state lines)

- Verify state-specific deductions and credits that differ from federal options

- Confirm state filing deadlines (which may differ from federal dates)

- Report any adjustments made to your federal return to state tax authorities

If you receive a notice from the IRS about changes to your federal return, you’ll likely need to amend your state return as well.

12. Rushing Through the Filing Process

Last-minute filing increases the likelihood of errors. When rushed, taxpayers are more likely to:

- Mistype numbers or personal information

- Overlook deductions or credits

- Forget to include necessary forms or schedules

- Make calculation errors

- Miss signature requirements

“Proper preparation prevents poor performance. This is especially true when it comes to tax filing, where mistakes can be costly.”

Start gathering your tax documents early, and set aside dedicated time to complete your return well before the deadline.

Avoiding Form 1040 Filing Mistakes: Final Thoughts

Filing your Tax Form accurately is crucial to staying compliant with tax laws and to ensuring you’re not paying more than necessary. By understanding the form’s requirements, deadlines, and available credits and deductions, you can navigate the filing process with greater confidence.

Whether you choose to file on your own or seek professional assistance, taking the time to organize your tax documents and review your return thoroughly can help prevent errors and delays. Remember that tax laws change frequently, so staying informed about current requirements is essential for successful filing.

For complex tax situations or if you’re uncertain about any aspect of your taxes, consulting with a qualified tax professional can provide peace of mind and potentially uncover tax-saving opportunities you might otherwise miss. At The Chamberlain Accounting Firm, we offer Accounting and Tax preparation services, from Individual (1040) and Business Returns (1065, 1120, 1120S) to providing complete Bookkeeping support, including dedicated solutions for Law Firm accounting. We assist clients throughout Bergen County, New Jersey, and surrounding communities, as well as in multiple states across the U.S. Contact us or call (201) 464-1011 for reliable, professional assistance tailored to your needs.

Frequently Asked Questions

If you discover an error after filing, you should file an amended return using Form 1040-X. Generally, you have three years from the date you filed your original return or two years from the date you paid the tax, whichever is later, to file an amended return to claim a refund. If the error results in additional tax owed, file the amendment as soon as possible to minimize penalties and interest.

Yes, you can file an amended return (Form 1040-X) to claim previously missed deductions or credits. However, you must do so within three years of filing the original return. After this period, you generally lose the ability to claim these missed tax benefits.

A tax deduction reduces your taxable income before calculating the tax you owe, while a tax credit directly reduces your tax liability dollar-for-dollar. For example, a $1,000 deduction might save you $220 if you're in the 22% tax bracket, while a $1,000 credit saves you the full $1,000 regardless of your tax bracket. This makes credits generally more valuable than the same amount in deductions.

The IRS recommends keeping tax records for at least three years from the date you filed your return, as this is typically the period during which you can amend your return or the IRS can assess additional tax. However, in some situations, you should keep records longer: six years if you underreported income by more than 25%, and indefinitely for certain records like those relating to property or business assets.

Disclaimer: This article is provided for general informational purposes only and does not constitute accounting, tax, or financial advice. The information contained herein is not intended to be relied upon for specific tax, accounting, or financial decisions, and may not reflect current tax law or guidance. No opinion expressed herein may be used for the purpose of avoiding penalties under federal, state, or local tax laws. Readers should consult with a qualified accounting or tax professional regarding their specific circumstances. This communication does not create an accountant-client or advisory relationship.